The more things change, the more they stay the same

As we entered into the new millennium, the industry had an optimistic, yet cautious outlook as to what the future held for the production engine remanufacturers and custom engine rebuilders.

When we asked various industry insiders this month to look into their crystal spheres, past issues such as regulations and OEM engine longevity are still an ongoing concern. Although knowing what we know now, a set of new issues are forcing the industry to recognize that the future is happening today.

Rich White, senior vice president of the Automotive Aftermarket Industry Association (AAIA) says when compared to the U.S. economy, the industry has been above average, but only contingent on the U.S. consumers’ driving and auto purchasing habits that ultimately affect production engine remanufacturers (PERs) and custom engine rebuilders (CERs).

“In reference to engine rebuilding, many forecast a decline as the initial engine quality continues to improve and durability contributes to longer engine life,” he explains. “The only major factor that conflicts with this prediction is vehicle neglect and excessively long drain intervals.”

After a rough patch toward the end of the last decade, the industry fought its way back while transforming into a leaner aftermarket player.

“After that hard hit, it helped our industry to consolidate, narrow its focus and become more nimble. It also created new opportunities for those willing to think outside of their normal experience,” says Paul Hauglie, president of the Engine Builders Association (AERA). “Couple this with the fact that there are fewer shops and you will see that these shops are not only surviving, but thriving. It has allowed the cream to rise to the top.”

With a shift toward new markets comes risk, he adds. “Some of the ways these shops are thriving is by capitalizing on new opportunities, such as specific performance or restoration work.” Hauglie says.

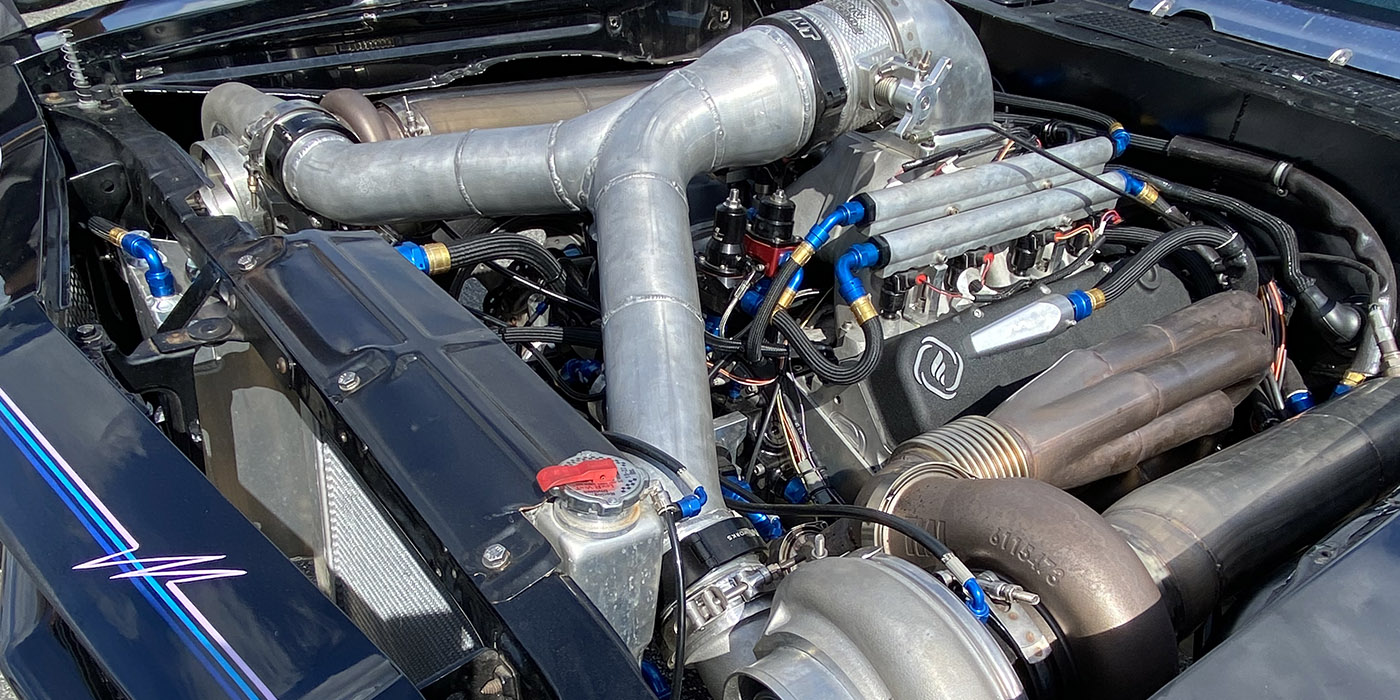

As more engine builders venture into niche markets such as commercial vehicles as well as performance and powersports engines, component manufacturers have positioned themselves to effectively attack their challenges, according to Rick Simko of Elgin Industries and chairman of the Engine Rebuilders Council (ERC).

“One thing I’ve learned over my years in this industry is that the most successful engine building businesses are the ones that are always looking for new opportunities,” says Simko, who is director of sales and marketing for the Elgin, IL-based manufacturer. “I recently saw a shop that had successfully expanded into jet-skis and other marine engines. One of the most appealing aspects of these categories is that the end-user tends to be far less price sensitive – it’s all about convenience, performance and reliability.”

Simko notes that the industry still faces challenges such as communicating its value to North American consumers. “We also have challenges in the way we as manufacturers and associations communicate critical technical information and best practices, not only from an engine rebuilding standpoint but also business practices such as marketing and customer relationship management,” he says.

Fighting the Good Fight

Ernie Silvers, CEO and president of Egge Machine Company, who is also active on many industry councils, explains that the march toward niche markets could be much smoother if state and federal regulators just got out the way. Going forward, the best way to fend them off, he says, is utilizing the services of industry associations.

“The biggest challenges for the industry in the next five to ten years will be government intervention, both in business regulatory and environmental concerns, and pushback from the big auto makers with regards to ‘right to repair’ issues,” Silvers says. “I know both major associations are working diligently to keep the peace with both state and federal legislators.

The automotive aftermarket represents billions of dollars in revenue – resulting in taxes paid – as well as millions of skilled jobs throughout the world. Our industry associations’ kindness and diplomacy ought not to be taken lightly or as weakness.”

In addition to legislative muscle, association heads contend they have successfully serviced their members through the concept of strength in numbers.

“Businesses join trade associations because an association can do many things that a single person or business cannot do on their own,” White says. “Whether it’s market research or government and regulatory affairs, an association has the expertise, resources and manpower to serve and protect its members. Call it economy of scale, trade associations provide leadership, connection and empowerment.”

Another concern facing the industry is the fuels that power the engines. Many like Production Engine Remanufacturers Association (PERA) President Robert McGraw as well as Hauglie tell us in the general sense that engines are leaning toward diesel, natural gas and electric. But let’s not write the obituary for the gasoline-powered internal combustion engine just yet.

“Pure economics will mostly dictate the fuels used in our engines but they may be using some alternative fuels. However, engines will be internally combusted for many years to come,” Hauglie notes. “If battery/electric-powered vehicles become more cost effective for consumers and viable for rebuilds, then that may be an emerging area for builders to look into.”

For manufacturers like Egge, a major player in the restoration market, Silvers sees the value in alternative fuels but said as long as Uncle Sam is kept at bay, internal combustion still has a home in the industry.

“Gasoline engines, from the hobby car perspective, will always be utilized, enjoyed and in need of remanufacture as long as the government allows them to be,” he says. “However, ethanol in gasoline is the government prescribed cancer that’s slowly killing the vintage engine market.”

Simko suggested Europe as a model for what’s to come for advanced technologies. Turbocharged engines are commonplace in most European countries and are steadily making inroads in the U.S.

“European nations are much father ahead in implementing advanced technologies that enhance engine fuel-efficiency and environmental sensitivity,” he says.

Another page to take out of the European playbook, Simko points out, is the region’s recycling requirements.

“Europe mandates that vehicle materials be recyclable, which is why engine parts manufacturers have been forced to eliminate lead from bearings and other components,” he adds. “Any push for increased recyclability could increase the public’s awareness of the engine rebuilding industry. The Engine Rebuilders Council has done a tremendous job

in the promotion of remanufacturing engines.”

The Good Ol’ Days of Stock Replacement Engine Work

As it worried so many in the aftermarket a decade ago, OEM engineering is still the proverbial thorn in the industry side. Some even fear that OEM engine work will eventually become nonexistent.

“Looking at the list of replacement rates reported in our Aftermarket Factbook, there are only three categories of engine work mentioned: computer, cooling fan motors and tune ups. There is nothing reported about engine rebuilding,” White said. “Looking at Lang’s product analysis, the engine repair activities are reported in three areas: engine bearings and engine parts, both of which are declining at annual rates of 3 percent and 14.8 percent respectively.”

Other association leaders such as McGraw and Hauglie have a more optimistic outlook for the future.

“The car makers will always have an engine that has inherent problems which can be repaired by most reputable shops,” Hauglie says. “The amount of OEM engine work has certainly declined, but it will not go away entirely. We’ve already been seeing this trend take place over the past 10 years.”

McGraw suggested a much simpler consumer dynamic.

“Everyday people needing to get their car back on the road are not an endangered species,” he says.

“Engines most often fail because of abuse or an inherent design flaw.”

Although engines are lasting longer, Simko says, they are also costing more to service with a rebuild coming in approximately three times cheaper than the cost of a new vehicle.

“It’s up to our industry to make sure consumers understand that discarding a vehicle or engine usually isn’t the most economically efficient choice,” Simko says. “We need to make sure this message is communicated at every industry point of sale, from the parts counter and repair shop service desk to the Internet. We’re simply not doing a good enough job of this today.”

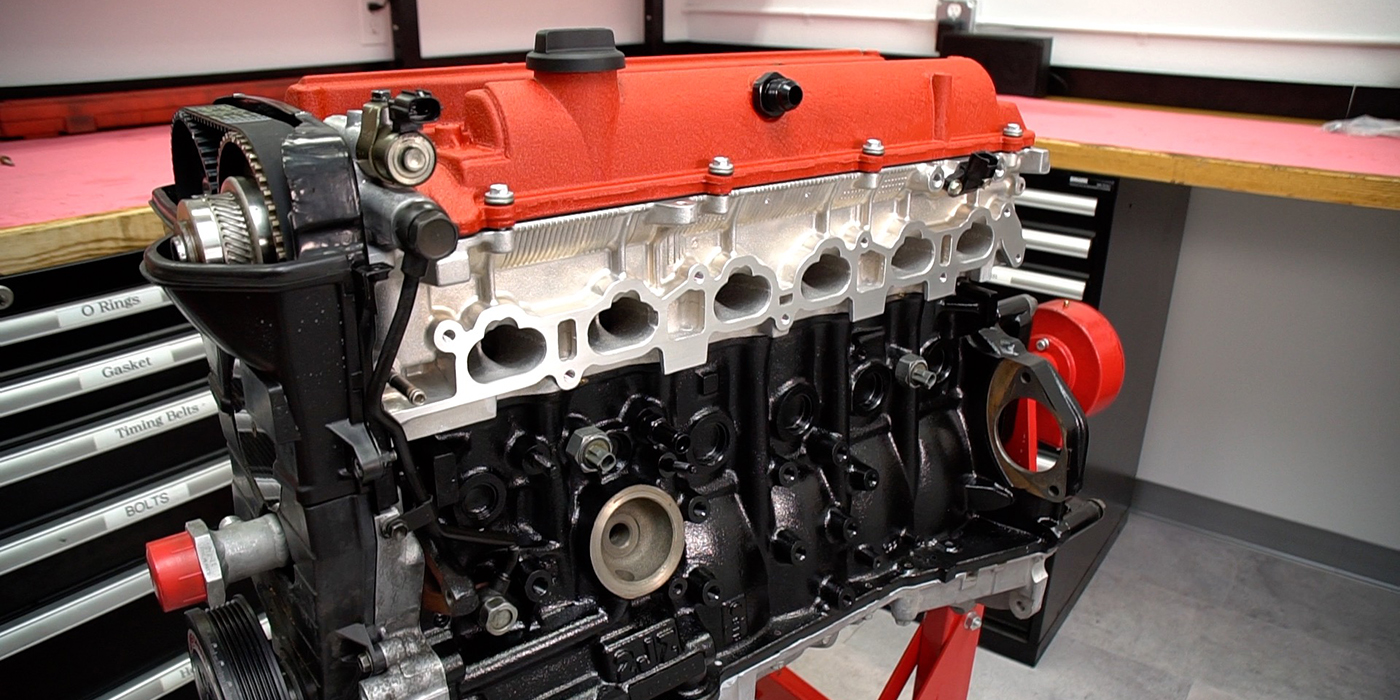

Others believe blocks and heads will continue to be highly rebuildable, but many internal parts will be manufactured in a way that will require the rebuilding process to involve new parts, putting the average machine shops’ viability into question.

“Getting new product is not always that easy,” McGraw says. “OEM engineers continuously make design changes, making the availably of new parts not possible. As engines become more advanced it is necessary to upgrade equipment to achieve these specifications.”

As the engine rebuilding community figures out solutions to these new challenges, those who have been in the business for some time know it’s best to focus on what’s in front of you and to stay ahead of the curve.

“Our biggest challenges are finding credible U.S. manufacturers. Though, there would be no automotive aftermarket without import products. These products, for instance, tend to be cheap, throw away parts that are killing some segments of the aftermarket,” Silvers exclaims.

“The smart shop owners will adapt, improvise and overcome most any obstacle placed in their path. Changing times always eliminate weak players. ‘Innovate or die!’”